Marx on Money by Suzanne De Brunhoff 1973 French, 1976 English

“The principle difficulty in the analysis of money is surmounted as soon as it is understood that the commodity is the origin of money” (Marx, Critique Ch 2)

Marx initially provides us (Critique, Ch 2; Vol 1, Ch 3) with an abstract study of the functions and properties of money, which he initially assumes is gold, “for the sake of simplicity” (Vol 1, Ch. 3)

There is no talk in this section of greedy, selfish, power seeking capitalists but only some passing references to how money can make fools of all of us. He is explaining money, not condemning it. He pursues this approach rigorously but without explaining why he approaches money in this way.

The strength of Suzanne De Brunhoff’s book is that she fills this gap. She explains that Marx is outlining a General Theory of Money and a Complete Theory of Money and the reasons why. My introduction to De Brunhoff here can’t be a substitute for reading her or even less a substitute for reading Marx. But I think her work is valuable because she provides some extra connective tissue to the body of Marx’s work, some overall perspectives that he didn’t provide.

Some essential background: the commodity

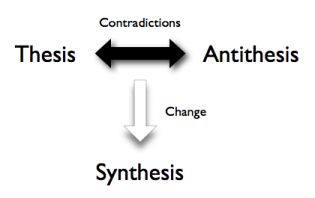

Both Marx (1818-1883) and his predecessor Ricardo (1772-1823) saw value as originating in labour. One difference between them is that Ricardo just accepted that as the way things were, whereas Marx saw value as a perverse social relation which would have to be overthrown.

Marx chose the commodity as the starting point of his critical study of capitalism and political economy. A commodity is different from a product in that it is both a use value and an exchange value. A product is just a useful thing whereas a commodity is produced for the purpose of being exchanged in the market place. Use values as products of labour are always useful no matter what the social system. Value, on the other hand, is a social category which arises from the exchange process.

You can imagine societies both past and future where there is no exchange of products and hence there would be no value category. eg. there would be no value in a hunter gatherer society where individuals or families provide mainly for themselves and there is limited exchange of products occurring. You can also imagine a future communist society where people just take the things they need from a commons, there is enough for everybody. There would be no exchange and no value category. “From each according to their ability, to each according to their wants”. Of course, such a society could not be arrived at immediately and the transition process is far from clear. But it can be imagined.

The Origin of Money is the Commodity

How does Marx’s commodity starting point relate to our understanding of money? What follows from the analysis of the commodity as a unity of use value and exchange value is that money originates in commodity value. Value is an abstraction that has to appear (reference Patrick Murray).Exchange value is the form of appearance of commodity value (reference Marx, The Value Form). Money crystallises value in a physical sense. Gold becomes money. The social relation of value (social because commodity exchange is a social process) ends up taking on a physical form. Since the exchange of commodities involves an equivalence relationship Marx describes money as the perfected form of the general equivalent.

Other economists don’t see money as originating from the commodity. A common view is that money is a convenient symbol to facilitate exchange, since barter is too inefficient. The quantity theory of money takes the view that the value, properties and quantity of money all originate from money itself and not from the commodity.

De Brunhoff argues that some “marxist’ economists make such errors as well as bourgeois economists. For example, Hilferding overestimated the importance of finance capital because he did not have a clear grasp of the fundamental functions of money (xiv)

If you don’t understand the origins of money in the value form of the commodity and even if you understand that value originates in labour, as a quantity, then you will lose your bearings completely when capitalists create different forms of money such as banking money. Money, as “the perfected form of the general equivalent” may cease to be metal but it can’t escape its origins in the commodity, which is a unity of use value and exchange value. Moneys’ essential functions (measure of value, medium of circulation, money – object of demand) can be traced back to the use value / exchange value contradictory nature of the commodity or evolve out of it. Those essential functions of money never go away even though capitalists create forms of money, such as credit, which attempt to negate those functions.

A “General Theory” of Money

Is money just part of the machinery of capitalism or does it have a broader necessity? The way in which the capitalist uses money, to employ wage labour and buy means of production, and the way in which the average worker uses money, mainly to buy necessities, suggest that some of its functionality is bound closely to the inner workings of capitalism whilst other of its functionality is more benign and may be useful in a post capitalist society.

By contrast, utopian schemes such as The Zeitgeist Movement and The Venus Project aim to overthrow “the system” by popular acclaim, abolish money and replace the market with computer surveys of peoples needs. Such movements by pass the need for a real analysis of the diverse functions of money.

De Brunhoff argues for the necessity of a general theory of money as distinct from a specifically capitalist theory of money. Sorting out the monetary problem consists

“… in knowing the meaning of this strange existence of money, inseparable but distinct from the other relations characteristic of capitalism … Hence a theory of money applicable to the capitalist system must be subsumed under a theory of money in general, valid for every monetary economy; in other words a general theory of money … Thus Marx considers it necessary to begin with a study of money in its general aspect, independent of the capitalist form of production in order, among other things, to determine its role in the capitalist form of production” (p. 19)

So, what is this abstract society that uses money but is not capitalist?

Marx’s study is based on an idealised scenario of a simple commodity economy, although De Brunhoff doesn’t use this phrase. I base my interpretation here on Maksakovsky:

“Simple commodity economy is production for exchange but without the use of wage labour. Artisans and private farmers produce commodities with their own means of production.” In its more developed form it involves monetary exchanges. (Maksakovsky, p. 37 FN33)

For the purpose of Marx’s analysis of money, the simple commodity economy involves:

– private production

– exchange of commodities using money

A simple commodity economy is not capitalism because capitalism involves ownership of the means of production and the hire of wage labour by those who own the means of production. The money used to buy means of production and wage labour is called capital. Capital can be money but not all money is capital.

Marx develops a general theory of the circulation of commodities and money. By contrast, capitalism develops institutions such as Banks and money such as credit, which are specifically designed for the needs of capitalism. Marx delays detailed treatment of these until Volume 3.

“One becomes unable to see how the general laws of monetary circulation continue to function in the capitalist form of production where there is a special monetary circulation, that of credit” (SBD, p. 20)

The three essential functions of money (measure of value, medium of circulation, money – object of demand) are spelt out in detail by Marx in both Critique Ch 2 and Capital Ch 3. De Brunhoff argues that all three of these functions have to be taken together as an ensemble “which in their entirety constitute the general theory of money” (p. 20) She criticises Hilferding’s Finance Capital for discussing inconvertible paper and credit before discussing the role of money hoarding, a part of Marx’s third function of money. “The monetary theory of credit involves a knowledge of the role of hoarding”. She argues that Hilferding makes a grave error in discussing capitalist money before outlining the entire general theory of money. (pp. 20-21)

The Good Abstraction

We have already explained the difference between a simple commodity economy and capitalism.

De Brunhoff also differentiates between a barter economy and a monetary economy. Once production transcends individual needs then, in becoming social, it involves exchange. The simple commodity economy that Marx discusses transcends barter and uses money for exchange. Once gold money emerges as always useful or the “god of commodities” (Marx) or as the universal equivalent then hoarding of this precious substance will follow. Hoarding becomes one of the essential functions of money (categorised under money as money). Marx chooses his starting point (private commodity production and exchange of commodities using money) because it is a “good abstraction” for explaining the fundamentals and subsequent development of capitalism.

“In simple circulation one studies the ebb and flow of money in relation to other commodities; this abstraction has the appearance of a visible datum, with all the brilliance and solidity of metal. In contrast, the network of debts and credits which Marx rejects as a starting point for the analysis of money, forms an immaterial circuit in which reciprocal obligations and rights confront and counterbalance one another. Why does the “good abstraction” take as its initial object the metallic material of money and not some of the elements already spontaneously abstracted by the very process of monetary circulation”? (De Brunhoff, p. 22)

This is because Marx begins his analysis of capitalism with the commodity and traces the origin of money back to the commodity. Gold emerges as the most suitable commodity to play the role of money. Furthermore, gold as the general equivalent of money excludes other commodities as the general equivalent. “It has a socially validated monopoly of equivalence, and this is what characterises its social function as money.” (De Brunhoff, p. 23)

Marx’s method here in choosing a metal as money is a good example of ascending to the concrete, as part of his dialectical approach. It could also be seen as utilising an object to think with. This was also a strategy employed by Seymour Papert, a modern day computer scientist and learning theorist in developing the logo programming language which features a turtle as an object to think with (reference). From the latter perspective a simple commodity economy as explained by Marx could be programmed fairly easily in today’s visual programming languages such as Scratch, Build Your Own Blocks or Kedama depending on the level of complexity required. This could be done up to the point of illustrating Marx’s quantity of money theorem depending on the price of commodities (directly) and the velocity of money (inversely).

This is the opposite of the idea that gold is a symbol of value. Gold is commodity money. Gold as money is distinct from all other commodities. Without a clear distinction between the money commodity and other commodities then all commodities would or could be money and money would be just another commodity. With such thinking the monetary privilege assigned to gold appears arbitrary and unfounded.

Some have argued in Marx’s time (Gray’s theory of labour money, Proudhon) and today (The Zeitgeist Movement and The Venus Project) that the key to solving the problem of capitalism is to abolish money or the privileged place of money. What this misses is that the origin of money, actually the necessity of money, is in the commodity with the commodity being a unity of use value and exchange value. Hence, to solve the problem of capitalism you have to solve the problem of the commodity, which is a far bigger or more fundamental problem.

Although it originates from all commodities, money is special and develops its own properties and functions distinct from other commodities. The important point is not the metal aspect but moneys’ unique role as the general equivalent.

Having established that money is a general equivalent form the next step is to articulate all the functions of this form. De Brunhoff stresses the importance of considering all these functions of money together “which complement one another, different yet necessarily linked with each other, which only in combination preserve and reproduce the general equivalent form … etc. (p. 25)

A “Complete” Theory of Money

(1) The Measure of Value (2) The Medium of Circulation (3) Money

“One is immediately struck by the discussion of the third point under the heading “Money” in a chapter entirely devoted to money and it various functions” (De Brunhoff p. 25)

Yes indeed! One aspect of this is that money as gold disappears. In Marx’s time gold money had disappeared in its role as (1) measure of value and (2) medium of circulation. And since Marx’s time it has further disappeared in its role as world money. So, money originates in the commodity and then more or less totally disappears.

This disappearance of commodity money highlights the importance of understanding Marx’s analysis of the fundamental functions of money based on its origin as a commodity. The material disappears but the functions do not.

a. Money, Measure of Value

What determines the general price level?

The subjective utility theories of price that overthrew and replaced Marx in mainstream economics have created a difficult problem for themselves that was already solved by Marx.

With gold as the universal money equivalent then the value of gold is determined by socially necessary labour time. Gold money can be used to assign price through a general equation:

x whatever commodity = y money commodity

and so commodities have a price before they enter circulation. Problem solved.

Note though that the actual presence of gold is not required for this function. To assign price through the above equation gold money does not have to be physically present. Ideal or imaginary money will do the job. It has become legally sanctioned as money of account pounds, shillings, pence, etc.

b. Money, Medium of Circulation

C-M-C

commodity – money – commodity

Money measures commodity value. Then “money as medium of circulation is not merely the manifestation but the practical guarantee of the role of money as measure of value” (p. 30)

Function 1, Measure:

1 ton iron = 2 ounces of gold

1 quarter wheat = 1 ounce gold

Function 2, Medium of Circulation:

1 ton iron → 2 ounces of gold → 2 quarter wheat

One ton of iron is sold for 2 ounces of gold which is then used to purchase 2 quarter of wheat. The physical presence of money in the circulation process acts as a practical guarantee that the measure of value function has been performed correctly.

De Brunhoff points out the intimate connection between Function 1 and Function 2:

“Only circulation, in which money effectively replaces the commodities, gives the fixing of prices its full significance. The first function of money is the condition for the second, but the second is the necessary complement of the first. Without this connection, money would have only a purely functional character, as medium of circulation, or a purely “ideal” character, as unit of account” (p. 31)

The anti-Quantity laws of money which Marx develops flow directly from the intimate connection between functions 1 and 2:

“… the quantity of money functioning as the circulating medium is equal to the sum of the prices of the commodities divided by the number of moves made by coins of the same denomination. This law holds generally” (Marx, Volume One, Ch 3)

Marx’s anti-quantity law is the opposite of the view that the quantity of money determines prices.

If the quantity of money in circulation depends on commodity prices then what happens if there is too much or too little money in circulation? This is where hoarding enters the picture, which is part of the third function of money:

“The difference between the total stock of gold and the amount which circulates is absorbed by hoarding … These points form the basis for Marx’s refutation of the Quantity Theory of Money. Thus the intrinsic connection between these functions rules out not only their separation but their presentation in any old order and their confusion with one another. Hence the metamorphoses of money in circulation (edit: she means here that money may change between gold, tokens, paper) do not raise any question about the value of gold as general equivalent and measure of value; they affect only the instrument of circulation” (p. 32)

This is all very clear provided money is gold. So we can surmise that Marx made money gold in part to make his argument clear or concrete. As mentioned above, it would be worthwhile to present this visually in one of the modern visualisation programming languages. Alan Kay, computer scientist, drew inspiration from learning theorist Jerome Bruner’s slogan “Doing with images make symbols” in developing etoys in smalltalk. (Alan Kay’s Educational Vision) We can write a program using gold as a concrete manifestation of the universal equivalent to make a qualitative and quantitative model of Marx’s version of the circulation process. Marx’s philosophy of ascending to the concrete can be programmed on modern media.

This is all clear when money is gold. But the reality is that gold money disappears.

“Its functional existence absorbs, so to say, its material existence. Being a transient and objective reflex of the prices of commodities, it serves only as a symbol of itself, and is therefore capable of being replaced by a token” (Marx, vol 1, Ch 3)

In circulation the wear and tear on coins reduces their weight and makes demonetization inevitable. The standard weight of gold coins ceases to be a real equivalent of commodities. Gold is replaced by tokens. Marx’s response to this is to say that the tokens which replace gold must represent the real value of gold quantitatively. Representative or symbolic money or tokens will suffice. Gold does not have to be present.

Nevertheless, it appears that the ongoing dematerialisation of money as governments introduce fiat money (government issued legal tender, inconvertible, used for the payment of taxes) into circulation appears to totally undermine or abolish Marx’s alleged laws of circulation.

“What Marx called ‘the inherent laws of circulation’, based on the role of the money commodity, appear to be abolished when the medium of circulation, with no intrinsic value, depends on government decisions which fix the amount issued.” (De Brunhoff, p. 33)

Since the Nixon Shock (1971) all reserve currencies including the dollar and euro have been fiat money

De Brunhoff goes into Marx’s differences with Ricardo, who supported a Quantity theory of money, that the amount of money in circulation determines prices. What arises from that discussion is the need to distinguish between the different roles of the different types of money – gold, fiat, credit. Tooke and Marx criticise Ricardo for attributing the same economic role to different types of currency. Ricardo was obsessed with the quantity of money in circulation without distinguishing between the different types of money.

The different types of money arise from the different functions of money:

– measure of value

– medium of circulation

Ricardo’s mistake was that he “regards currency, the fluid form of money, in isolation” (Marx, Critique, Ch 2)

This comment by De Brunhoff is crucial:

“The loss of metallic substance in circulation never results in reducing money to a mere medium of circulation. Rather, it is an indication of the functional difference between money as measure of value and money as an instrument of circulation” (p. 35)

How may these different types of money be categorised?

De Brunhoff quotes Charles Rist to good effect here:

“The theory of paper money is to that of metallic money as in medicine the study of the pathology of an organ is to that of its normal anatomy and physiology” (p. 35)

Marx is very clear that credit follows different laws to true money and so separates off and delays the discussion of credit to volume 3.

“During the following analysis it is important to keep in mind that we are only concerned with those forms of money which arise directly from the exchange of commodities, but not with forms of money, such as credit money, which belong to a higher stage of production” (Marx, Critique, Ch. 2)

So gold is true money (but no longer exists legally!), credit is false money (because it is only of use in circulation, functions 1 and 3 are ignored?) and the US dollar is diseased money (legal but printed in excess – Quantitative Easing)? This need further clarity.

Is fiat money true, false or diseased? De Brunhoff is ambivalent here. See page 36. She says it is true insofar as it represents or symbolizes gold. But then suggests it is false because it is condemned to remain in circulation, that it can’t be hoarded. Remember that the ability to hoard, the third function of money, is necessary to complement the other two functions, since hoarding is essential to control the quantity of money in circulation. She concludes that fiat money is true but bad money. But is this true, don’t banks withdraw paper money? I’m confused about this issue of whether or not paper money can be hoarded.

Was Marx a metallicist? No, but he was a 3 way functionalist who asserted that true money, commodity money, which originates before capitalism, followed definite laws. And these laws do not magically disappear when full blown capitalism arrives and develops it own forms of diseased money such as credit.

The important issue is the starting point. If you start your analysis of money with fiat paper money which is arbitrarily added to circulation you are bound to get it wrong:

“It is thus evident that a person who restricts his studies of monetary circulation to an analysis of the circulation of paper money with a legal rate of exchange must misunderstand the inherent laws of monetary circulation. These laws indeed appear not only to be turned upside down in the circulation of tokens of value but even annulled; for the movements of paper money, when it is issued in the appropriate amount, are not characteristic of it as token of value, whereas its specific movements are due to infringements of its correct proportion to gold, and do not directly arise from the metamorphosis of commodities.” (Marx, Critique, Ch. 2)

So, what are Marx’s laws of money?

- The quantity of true money (gold) in circulation is directly proportional to the sum of prices of commodities and inversely proportional to the velocity of circulation of the money

- The quantity of tokens in circulation is equivalent to the quantity of true money (gold) that the tokens represent

Gold can’t be replaced by things without value, by symbols, except when it is means of circulation. An awareness of 3 functions of money and how they are intimately connected is essential to appreciate this. Circulation allows tokens – coins, paper – it does not negate the other functions

“Paper money is a token representing gold or money. The relation between it and the values of commodities is this, that the latter are ideally expressed in the same quantities of gold that are symbolically represented by the paper. Only in so far as paper money represents gold, which like all other commodities has value, is it a symbol of value. [37]“ (Marx, Vol 1, Ch 3)

In the footnote Marx is incredulous at Fullarton for thinking that the replacement of gold with paper symbols can be interpreted as meaning that gold no longer represents the value of commodities or a standard of price.

c. Money, Instrument of Hoarding

Hoarding

The possibility of hoarding arise from the coming into existence of the universal equivalent as a real, material substance. The commodity circuit C-M-C splits into C-M and M-C. Someone sells a commodity and acquires money. Their is no obligation for them to spend that money immediately. Hence, C-M-C is very different from C-C, direct commodity exchange.

The desire for hoarding is simply money lust, money as the ideal abstract wealth.

The real economic function of hoarding is as a regulator of functions 1 and 2, to keep the right amount of money in circulation.

Does money solve the problem of equilibrium between functions 1, 2 and 3? De Brunhoff has some discussion on the differences between Marx and Keynes in their treatment of liquidity and the problem of the limited supply of money. That required further study.

The C-M-C split into C-M and M-C suggests the possibility of crisis because the possibility now arises that buying and selling will no longer be in equilibrium. There is no guarantee that those who buy will sell. But the possibility of crisis is a far cry from the reality of crisis. Marx has shown that for a simple commodity economy there can be equilibrium. Money as such is not the problem. Capitalism is the problem.

“This long analysis explains nothing, nothing except the conditions of the existence of money; by doing this, it prevents the disruptive intrusion of the analysis of money into that of production …” (De Brunhoff, p. 43)

Money is not as important as we tend to think it is. Money is more of a reflection than a source of problems. The diseases of money arise from capitalist production and circulation. Look for the real dynamic behind the veil of money. Money can get in the way of our understanding of the real dynamic

d. Money and Social Power

In the rough drafts of his works (early drafts of the Critique and Grundrisse) Marx discussed the social power accruing to individuals and notions who hoard money.

“But Marx did not retain these analyses of the political and social power inherent in money as a part of his theory of money” (De Brunhoff, p. 46)

This is in stark contrast to those reformers who see “money as the root of all evil” or the elimination of money as the nirvana which will solve all social problems. It is true that money is power but that is more to do with Capital, not money as such. Money accumulates to certain individuals. They have privileges. Some go onto become successful capitalists. But money is not the same thing as Capital. Capital needs to be dealt with later after establishing the fundamentals of money.

The State / Central Bank has some apparent control over money and can exercise power through monetary policy. They can decide to maintain or not maintain a gold standard, they can print more paper money, they can alter interest rates and control credit through fractional reserve banking policies. However, what follows from the outline of Marx’s fundamental functions and laws of money is that in the final resort all this power is more apparent than real.

Conclusion

Marx’s anti-quantity theory is based on the coherence of the 3 functions of money (measure, medium, hoard). It follows that the quantity of money in circulation is proportional to the sum of prices. Capitalist money such as credit floods the money market and breaks Marx’s law. We can either retain Marx’s law and query the legitimacy of capitalist money, ie. see it as diseased, or, we can see all money as non diseased. If we do the latter then money doesn’t make a great deal of sense, fundamental truths of the functionality of money and capitalism are lost and we are left in a sea of confusing surface phenomenon. That is my understanding at this point.

Some big questions epistemological questions need to be kept in mind:

- Is it possible for any of the 3 functions of money described by Marx or their intimate interrelation to be somehow negated?

- How is it possible for a non commodity such as the diseased US dollar to measure value accurately?

update (10th Jan): This review of Suzanne de Brunhoff’s book is only a review of Part one: The Marxist Theory of Money.. Hopefully, I’ll also be able to review her part 2: Money and Capitalism, which refers extensively to Vol 2 and 3 of Capital.

Further Study

Updating by De Brunhoff of her original book:

De Brunhoff (2003) Marx’s contribution to a search for a theory of money

How can paper money represent Value? Articles which argue how fiat paper money can replace gold as a measure of value (MELT = monetary equivalent of labour time)

Duncan Foley (2003) Marx’s Theory of Money in Historical Perspective

Fred Moseley (2004) The “Monetary Expression of Labour” in the Case of Non-Commodity Money

Article with some original ideas about the real function of credit:

Campbell, Martha (1997) Money in the Circulation of Capital

A modern fundamental challenge to Marx’s concepts:

Likitkijsomboon, Pichit. Marx’s anti-quantity theory of money: A critical evaluation

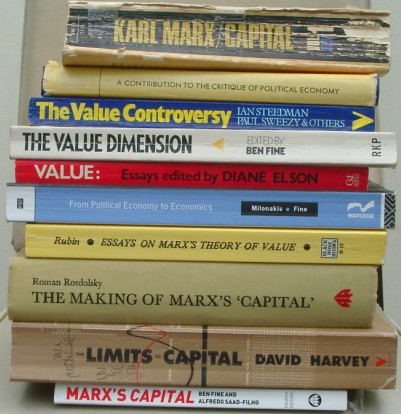

References

De Brunhoff, Marx on Money

Hilferding, Finance Capital

Maksakovsky, Pavel. The Capitalist Cycle

Marx, Grundrisse

Marx, Contribution to the Critique of Political Economy

Marx, Capital, Vol 1

Marx, The Value Form. Appendix to the first German edition of Capital

Murray, Patrick. Money as Displaced Social Form: Why Value cannot be Independent of Price

The Venus Project

The Zeitgeist Movement

Recent Comments