Steve Jobs’s range of achievements is impressive: the Apple computer, the NeXT computer, Pixar and then his return to Apple to lead development of the iPod, iPhone and iPad. eg. Tim Berners Lee spoke very highly of NeXT and used it to develop much of his world wide web technology.

Many people love his products (hi pat!) because they enabled them to make use out of computer technology that they could not achieve through the relatively clunky alternatives provided by Bill Gates and others.

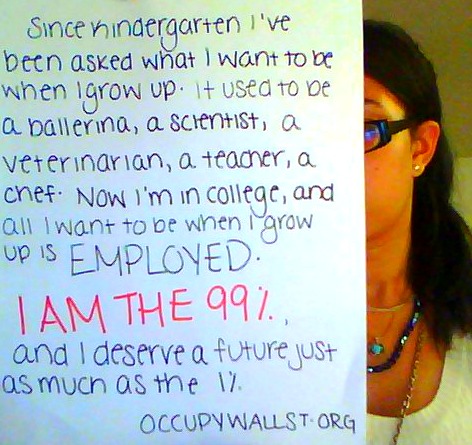

I’ve been thinking about Jobs from the POV of how his talents would have played out, if at all, in another type of society, call it socialist or post-capitalist. It has been an interesting thought experiment for me. Jobs definitely did have a dark side as well as being quite talented in certain respects (and not talented in other respects). I’m interested in the question of creativity in the development of computing and in this case what type of creativity Jobs had and how that played out in our current social system.

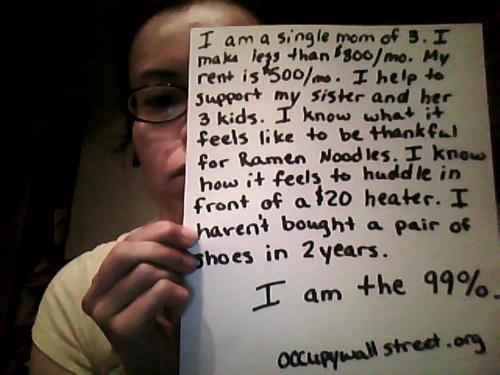

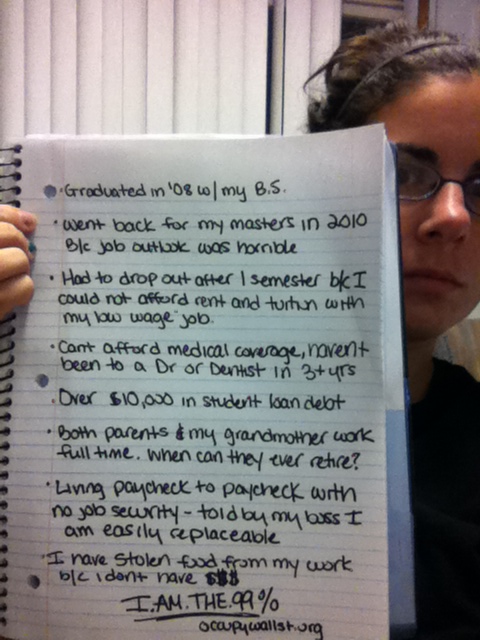

Of course it’s trite to say that Jobs had a dark side. Everyone has a dark side. The political point is that the focused ruthlessness he directed against some others and institutions was magnified and rewarded by the capitalist system. From my reading (see references below for more detail) Jobs as a capitalist personified was worse than some of the others. Marx’s fundamental point about commodities is very relevant here. In pursuing commercial success in perfection in things Jobs treated many people badly.

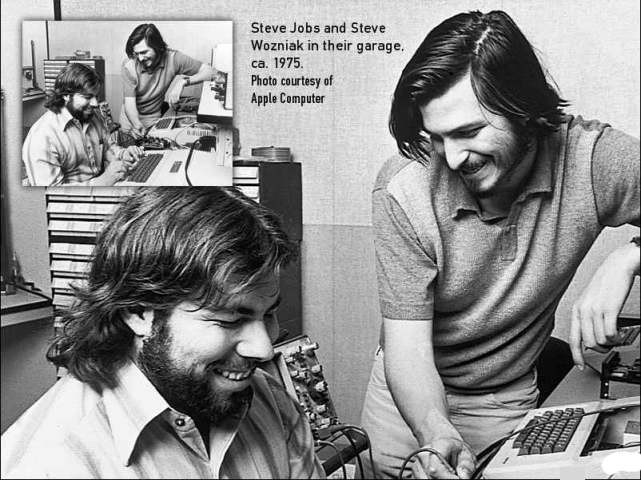

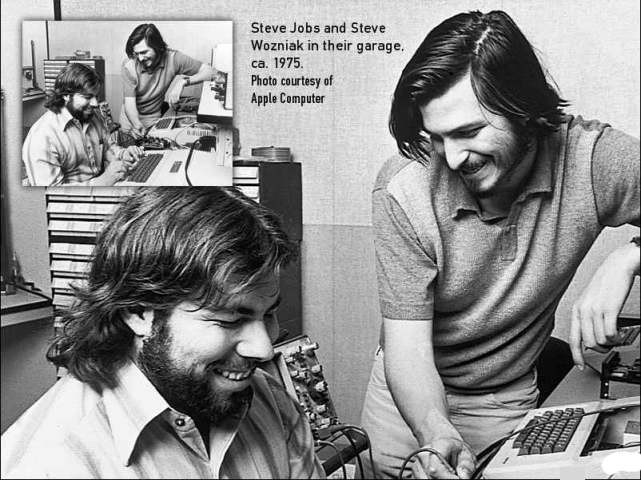

It’s clear that much of what Jobs achieved was achieved by his partners. Wozniak did most of the work in developing the Apple computer. In Wozniak’s words (recent interview) it was he who worked in the famous Silicon valley garage while Jobs worked out of his bedroom, making phone calls, doing the marketing.

The same is true for the development of the WIMP interface (Windows, Icons, Menus, Pointers). The fundamental work here was done by teams led by Doug Engelbart and Alan Kay and made available for free for others to use. Jobs could see the potential and developed it commercially.

The truth of the matter is that the fundamental developments in both computing hardware and software were given away by the real pioneers of the computing revolution. Their motivation was that of scratching a personal itch, of immersing themselves in the exciting possibilities of a new technology and what could be achieved with it. The names of those pioneers are less well known than the names of those who converted their spirit of freedom into commercial success.

Jobs said about the Mac development:

“I don’t think I’ve ever worked so hard on something, but working on Macintosh was the neatest experience of my life. Almost everyone who worked on it will say that. None of us wanted to release it at the end. It was as though we knew that once it was out of our hands, it wouldn’t be ours anymore. When we finally presented it at the shareholders’ meeting, everyone in the auditorium gave it a five-minute ovation. What was incredible to me was that I could see the Mac team in the first few rows. It was as though none of us could believe we’d actually finished it. Everyone started crying.” [Playboy, Feb. 1, 1985, source, my emphasis]

The words I have bolded sums up the dilemma of creative people who decide to become highly successful under capitalism. Once the interesting, creative process is completed then you have to do the hard work of promoting and selling your product in a highly competitive market. Clearly Jobs was very good at the latter.

Anyway, here are some interesting quotes and references I have discovered in my search for the real Steve Jobs:

Richard Stallman:

“Steve Jobs, the pioneer of the computer as a jail made cool, designed to sever fools from their freedom, has died”

– source

Eric Raymond: On Steve Jobs’s passing

Commerce is powerful, but culture is even more persistent. The lure of high profits from secrecy rent can slow down the long-term trend towards open source and user-controlled computing, but not really stop it. Jobs’s success at hypnotizing millions of people into a perverse love for the walled garden is more dangerous to freedom in the long term than Bill Gates’s efficient but brutal and unattractive corporatism. People feared and respected Microsoft, but they love and worship Apple – and that is precisely the problem, precisely the reason Jobs may in the end have done more harm than good.

The Eric Raymond article links to a very interesting NYT article titled Against Nostalgia by Mike Daisey but unfortunately it is now hidden behind their firewall.

There were some correct criticisms of Eric Raymond’s dismissive attitude to China’s sweatshops at reddit.

What Everyone Is Too Polite to Say About Steve Jobs

Recent Comments