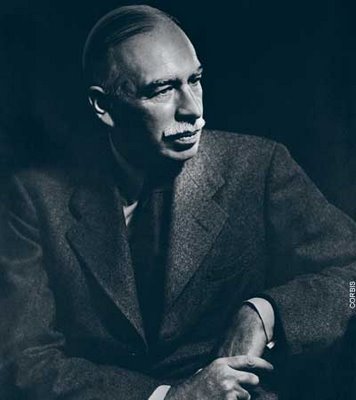

John Maynard Keynes (1883 – 1946)

It seems like a good idea to focus Keynes discussion in one thread since it has already begun in other threads, particularly marx and the domains of ignorance.

What is the Keynes solution to economic crisis?

… a relatively painless route to recovery is offered by loan-financed public investment, increased government spending generating the income that, through increased tax revenue and savings, will provide the resources to finance the increase in expenditure and that will justify the expansion of the money supply required to fund the initial deficit

– Keynesianism, Monetarism and the Crisis of the State by Simon Clarke, p. 238 (source)

Of course, this is open to interpretation.

His original main work is: The General Theory of Employment, Interest and Money by John Maynard Keynes (1936)

Lupin3 has suggested we read: Mr. Keynes and the Moderns by Paul Krugman

Please post your questions about Keynes, Keynes references and Keynes analysis here.

THE KEYNESIAN READER

The General Theory of Employment, Interest, and Money by John Maynard Keynes, available in epub format for digital readers.

Per Krugman’s Keynes and the Moderns, critical passages of the General Theory include:

Book One – Introduction

Chapter One – The General Theory

Chapter Two – The Postulates of the Classical Economics”

Chapter Three – The Principle of Effective Demand

Book Four – The Inducement to Invest

Chapter Twelve – The State of Long Term Expectation

Chapter Thirteen – The General Theory of the Rate of Interest

Chapter Fourteen – The Classical Theory of the Rate of Interest

The “Keynes” page at Berkley by Brad DeLong. Frustratingly haphazard, but subject oriented quotes may provide points of departure for further research.

Intro to Keynes’s General Theory by Paul Krugman.

A Keynesian Takes on Karl Marx, by Sam Williams. Incredibly and irritatingly discursive, Mr. Williams does make some interesting points which seem to expose the orthodox Marxist response to Keynes. As such, they may merit further discussion.

Why Aren’t We All Keynesians Yet? by Paul Krugman.

There’s more to come, in particular highlights and/or questions about Mr. Clarke’s write up, which was kindly provided by Bill.

Thanks, I’ve downloaded the epub and will try to read those chapters after finishing Hilferding (postponing Hegel and Simon Clarke).

Meanwhile I have about 50 windows open to links from:

http://en.wikipedia.org/wiki/2008%E2%80%932009_Keynesian_resurgence

Will take a while just to refresh my purely superficial acquaintance.

I agree its necessary to have a reasonably thorough appreciation of actual Keynes and variants, at least beyond the level of undergraduate macroeconomics texts and especially including Minsky.

Meanwhile I’ll continue to conflate expansionary fiscal and monetary policies with “Keynesianism” since that usage, although not precise, seems to broadly correspond to the common usage as mentioned at above link.

My view remains that such policies have been followed more or less universally in practice, while remaining disputed in academia. I think a deep crisis would have occurred earlier without them, but all they are able to do is postpone the crisis and at the same time intensify it.

As I understand it the aim of these policies is to prevent a deflationary spiral. Consequently they extend the disproportions between sectors of the economy and the wide gap between prices and values (production prices) that only the crisis and devaluation can restructure and rebalance.

I hope to eventually try to respond here to Lupin3’s comments from two previous threads as well as to new material here. But I have to apologize as I simply don’t know when that will be possible.

I’m rereading parts of John Maynard Keynes by Hyman Minsky. Ch. 8 Social Philosophy and Economic Policy. It’s good.

In broad terms there were 2 lessons to be learned from The General Theory:

(1) Government intervention in the economy is essential to maintaining what is named as “full employment”. eg. build roads, pay for education and hospitals, armaments and space adventures

(2) Redistribute income from the rich to the poor – government sponsored subsidised consumption – social security, welfare, food stamps, medicare etc.

Keynes supported snipping off the upper tail of income distribution by taxation (the policy which has just been blocked by The Tea Party / Republicans in the USA)

Minsky argues that (1) has become popular wisdom in formulating economic policy but not (2), that “when conservatives are Keynesians, then tax and spending policies may well be used to give life to rentiers rather than abet their euthanasia” (p. 158)

So, arthur, it upsets you when people claim they are marxists when they are not, so you should be able to understand lupin3’s upset (here) when you inaccurately describe Reagan and Thatcher’s policies – and the rest of them – as Keynesian, when they are not.

Interpretation of Keynes model or models of the economy

lupin3 on aug 9:

lupin3 on aug 13

I don’t understand the Keynes model/s or the maths of the models as explained by Keynes, Minsky or Keen.

The only point I want to make here, lupin3, is that Minsky argues on pp. 50-51 of John Maynard Keynes that there are various standard models derived from The General Theory and that they are either trivial (the consumption function models), incomplete (the IS-LM models without a labour market), inconsistent (the IS-LM models with a labour market but no real balance effect) or indistinguishable in their results from those of the older quantity theory models (the neo classical synthesis).

Minsky goes onto build his alternative models which he claims reveal an instability of capitalism that is not clear in standard interpretations of Keynes and not even very clear in the Keynes original. Steve Keen is another mathematical modeller who takes Minsky as a starting point.

The only point I’m making is that there are many Keynes models and they are contested and incomplete. My working hypothesis is that all those who have claimed to accurately model the capitalist economy have turned out to be wrong. Keen does not claim his models are complete. Econometrics as science has turned out to be a form of lunacy. My guess is that they would have to be wrong because they don’t understand how the economy works in its fundamentals.

Hence, the need to start with Marx, although the implications of his value in motion approach are also not clear to me. Those who interpret marx’s value as primarily a quantitative measure also have egg on their face.

Steve Keen wrote a critical article about Paul Krugman earlier this year in March:

“Like a Dog Walking on its Hind Legs”: Krugman’s Minsky Model

Keen is part of the Post Keynes school and critical of Krugman for being part of the conventional “Keynesians”, part of the neo classical synthesis initiated by Samuelson as the end of WW2. This group was referred to by Joan Robinson as “bastard Keynesian” for sucking the revolutionary lifeblood from him.

Note Keen’s recommendation for Minsky’s Can “It” Happen Again: Essays on Instability and Finance

Reviewer, James Mueller, seems to have a good handle on Minsky’s Financial Instability Hypothesis:

But last week Keen thought that Krugman had lifted his game:

Sense from Krugman on private debt. Note the comment at the end of Keen’s second article:

From Monthly Review, an article which usefully compares various Marxist and Keynesian perspectives not just on the current crisis, but on the broad economic strategies after the 1960s.

The Limits of Minsky’s Financial Instability Hypothesis as an Explanation of the Crisis

Thanks for the link. I’ve now read the three articles (Palley, Foster & McChesney and Magdoff & Sweezy).

I certainly agree that its important to study and understand this sort of stuff. Unfortunately my eyes glaze over so much that I don’t feel up to commenting yet.

(Except to mention that neither the “new” nor “orthodox” Marxism mentioned have any connection with Karl).

I do want to return to these particular articles. Refutations would be very useful.

Meanwhile I can only again recommend Maksakovsky as much closer to an “orthodox” account.

Also, when I looked at the levy institute stuff on Minsky a while back, it struck me as a good account of the financial phenomena. But as Marx explained:

http://www.marxists.org/archive/marx/works/1867-c1/ch25.htm#S3

The US-centric anti-globalization focus of Palley was especially striking in the face of what is so obviously a global crisis.

Lupin 3 Marx saw money as a phenomenon of commodity as did Adam Smith and as do the Austrians

Keynes was part of the group that during the 1920’s overthrew this ancient idea and asserted that money is a phenomenon of credit.

I can’t see how these ideas could ever be reconciled and I think that it is partly why either side can’t make sense of the other for both percieve the other as talking jibberish.

There is an OCR “Pavel Maksakovsky – The Capitalist Cycle.pdf” at:

http://depositfiles.com/files/nh8a9s9zg

I agree with steve that the theory of everything or even something cannot be arrived at until we solve the riddle of money. Hence, the need at some stage for a thread on money.

Lupin 3, I am reading your references but was delayed due to other commitments. In the Paul Krugman introduction to Keynes GTEIM I thought this part was quite important:

Hence, Keynes is about a strictly technical analysis of how to save capitalism from its worst excesses / inefficiencies whereas Marx was someone who really wanted to understand capitalism in its fundamental workings. I accept the point that Krugman makes that this, in its way, does make Keynes more potent than I thought of him before but also far more limited than Marx in his scope.

The Mr Keynes and the Moderns reference demonstrates that Krugman speaks for himself and not for Keynes given that he is a Book 1er and not a Chapter 12er. I think there is a philosophical significance here, Lupin3. Marx, especially, stressed the contradictions in all things whereas Krugman quite openly favours equilibrium interpretations. Does this prove that capitalism can’t be saved? No. But a does demonstrate a difference in philosophical outlook.

Hyman Minsky, who also stresses capitalist instability also attaches great importance to Keynes 1937 QJE article, The General Theory of Employment (not to be confused with TGTEIM) as the real Keynes as Krugman concedes. So add that one to the reading list.

Not sure why you provided us with this reference, Lupin3, perhaps you were checking to see if we read your links 🙂 but it does show that Krugman is narrow minded and suffering from the usual anti marxist disease, not being able to give any credit where it is due.

Here is another new reference which I came across in trying to figure out the real differences b/w Keynes and Friedman: Is Milton Friedman a Keynesian It’s an analysis by an Austrian economist, Roger Garrison of the similarities and differences b/w Friedman and Keynes from his critical pro Hayek perspective. ie. the similarities are important as well.

Still reading …

This static conception and failure to grasp crisis and depression as essential phases of the dynamics of the capitalist cycle is central to the superficiality of Keynes compared with Marx.

I think the following from Chapter 3 of Maksakovsky throws great light on current “policy” debates:

The parallels are rather striking between the methods Maksakovsky says will only prolong the overproduction and disproportion between price and valeue while intensifying the resulting eventual crisis and the measures recently taken that are feared to have produced just that result. (On the other hand the long “Great Moderation” in which credit was regularly deliberately tightened to prevent “overheating” suggests that modern central banks was to some extend able to carry out the better policy he said it that banks could not implement. But they only tried to moderate “overheating” while never actually permitting the crisis to break out and actually restore proportionality. So here we are with it breaking out anyway.

I’ll just add that central to Marx’s superiority highlighted by the above are:

1) A theory of value, without which it is impossible to conceptualize the reality of a cycle in which prices deviate from values, disproportions between branches of production and consumption grow and both have to be brought back into their necessary proportions as aspects of a unified whole through crisis.

2) An understanding of actual money as the necessary embodiment of abstract socially necessary labor time for which other commodities have to actually be exchanged so that “effective demand” cannot simply be created by fiat and banks do not have magical powers.

I’ll also throw in that the impossibility of separating commercial credit and investment credit appears to be central to the problems they are running into. They can avoid a credit and monetary crisis by supplying unlimited credit at zero interest, but the inevitable result is speculation and bubbles since the underlying overproduction does not enable actual realization of the overproduced commodities or profitable outlets for productive investmet.

That’s a nice thumbnail of a marxist retort to the Keynesian position, arthur. Nevertheless, I still feel the need to understand more of the detail of the Keynes and Minsky and Keen’s positions, including their maths. Also, I still think David Harvey does a good job of presenting a similar position to the one you are putting, eg. see his Ch. 10, sec 7: Inflation as a Form of Devaluation of Limits to Capital, to quote one paragraph from his more detailed argument:

Much of the criticism Bill and Arthur have made of Keynes is predicated on the relative specificity of Keynes’s theory, as opposed to Marxism. There is an intuitive basis to this criticism, which is that in explaining how to get of this mess, it is important to understand how we got in it.

However, there is an implicit tendency because of this (in much of this thread so far, and others which are related) to criticize Keynes because of this specificity, and to credit Marx (or rather his interpreters) with comprehension because of the comprehensiveness of his theory. This prejudice can distort one’s ability not only to understand Keyensianism, which Arthur seems not to understand at all, but also even Marxism. Or at least, the relevance of orthodox Marxism.

An analogous distortion is employed by Tyler Cowen:

This is in response to Krugman’s criticism of NY Times article by Robert Barro, in which Barro argues for long term policies responses in the short term. To which Krugman responds:

Mark Thoma responds to Cowen by suggesting that the appellation of “New-Old Keynsian” is beside the point:

Now the question is, what is Marx/Maksakovsky modeling, and how relevant is it to our current crisis?

I plan to examine that question in more detail shortly. Still, I’d suggest that anyone arguing for the superiority of Marx (to Keynes) in the Maksakovsky passage had probably better have some empirical evidence to support it. Thoma’s comments are instructive here.

I agree with you about modelling, Lupin3, but not about empirical evidence. The empirical evidence so far is that socialism failed. You can’t create a new world out of empirical evidence. You have to destroy the old world before the empirical evidence becomes clear.

With respect to the modelling I remember reading about Richard Feynman saying that physicists have a wide variety of models to choose from when thinking about cutting edge stuff or even more established ideas and they tend to cycle through the models trying to establish the best fit on the available data.

I want to get a real handle on the various Keynes models, including Hick’s IS-LM which is not real Keynes but influential, not as an endpoint, but as one of the various models to cycle through when I think about the economy. I don’t feel I have an expert grasp of any of the models yet.

Couldn’t find the Feynman quote but did find something a bit similar:

Marx and Maksakovsky are trying to produce an abstract or “pure” model of a capitalism that is does have a cycle with crises. This is a necessary preliminary to any attempt at empirical modelling of actual conditions.

What I don’t understand is the concept of modelling empirical data as “shocks” to an “equilibrium” instead of actually having a theory about the non-equilibrium dynamics.

This quote from Thoma unconsciously highlights the absurdity:

http://www.thefiscaltimes.com/Columns/2011/08/30/What-Caused-the-Financial-Crisis-Dont-Ask-an-Economist.aspx#page1

They really ARE so convinced that capitalism doesn’t have cycles and crises that data prior to 1947 (when it obviously did) simply doesn’t exist for them! What hope do they have of understanding anything?

particularly like the krugman quote “you don’t have to refill a flat tire through the hole.”

While this is true there is no point pumping air into it if you haven’t found the hole.

Useful background reading for Maksakovsky includes:

1. Hilferding’s Finance Capital (from an “Austro-Marxist” perspective)

2. Wilhelm Ropke “Crises and Cycles” (from an “Austrian” bourgeois mainstream perspective). The 1936 english edition is adapted from the foundation of the 1932 Krise and Konjunktur (post- Great Depression) whereas Maksakovsky references a 1922 German work on Konjuntur and a Russian 1927 work that is presumably a translation of the 1922 original. It discusses a lot of sources used by Maksakovsky, (though not Hilferding). Linked from here:

http://en.wikipedia.org/wiki/Wilhelm_R%C3%B6pke

I was having trouble understanding the IS-LM interpretation of Keynes but this tutorial is clarifying it for me:

Macroeconomics tutor

Hyman Minsky’s John Maynard Keynes assumes knowledge of this and other models. He then does a critical analysis of the consumption function model, the IS-LM framework, “the labour market and the IS-LM framework” and the neo classical synthesis (chapter 2). Later in the book he proceeds to his alternative interpretation of Keynes.

Thanks for the macro tutorial link.

I read the first web page and then watched the more or less identical video. Easy to follow, but hard to believe!

1. If AD at equilibrium equals Y, what happens to intermediate goods (“constant capital”)??

2. How can there be a single c for MPC of .aggregate) “households”. Workers have a life cycle average c of 0 while capitalists do all the net accumulating. Anything relevant to cycles surely has to distinguish savings out of profits which vary with profitability!

3. Even the trivial algebra is wrong. At the last step c * TRansfers is taken as an exogenous constant (included in A bar) at the same time as showing the effect of varying the “constant” c while A bar remains constant.

4. I will press on as its obviously necessary to be familiar with the fairy tales told to economics students. But I don’t see why even the most unquestioning would just accept being dogmatically told that:

5. A propensity to consume more directly results in higher income.

6. Imports are a negative part of AD instead of a part of “supply”.

7. There is a positive minimal level of consumption with zero income.

I’m getting this off my chest before proceeding because its what makes my eyes glaze over BEFORE reaching the more “serious” IS-LM stuff. So I won’t feel compelled to list similar problems while just trying to appreciate what the arbitrary random dogmas in their catechism actually say.

arthur,

I came across a recent review of Hilferding’s Finance Capital written by JE King, School of Economics and Finance, La Trobe University and published by the Australian History of Economic Thought. Article 4 on this page.

Thanks, I’ve just finished Hilferding as well as the review. Won’t comment except to confirm that Hilferding is necessary reading (and not too (“heavy”).

Also the review mentions Anitra Nelson on “Marx’s Concept of Money”:

http://ebookee.org/go/?u=http://depositfiles.com/files/rdx8rlzm7

Looks interesting.

Have finished the IS-LM tutorial and am suitably unimpressed. Hadn’t realised the “conventional wisdom” was THAT superficial.

Thanks for Anitra Nelson download link, arthur

off topic: She works at RMIT (bio) and is also the co-author of a recent study on Mortgage default in Australia: nature, causes and social and economic Impacts. Just about time to start a thread on the escalating mortgage crisis in Australia.

Entertaining

Fight of the Century: Keynes vs. Hayek Round Two

httpv://www.youtube.com/watch?v=GTQnarzmTOc

or

http://www.youtube.com/watch?v=GTQnarzmTOc

if the embedding doesn’t work

arthur:

I think this happens because aggregate demand is equated with GDP, not necessarily by Keynes (I’m not sure) but since Keynes. And GDP is the total output produced within a country’s borders.

So, GDP, Y = C + I + G + (X – M)

C = consumption

I = investment

G = government spending

X = exports

M = imports

arthur:

Not sure what you are getting at here, arthur. In the current year new constant capital would be part of investment. Already existing constant capital, from previous years, I presume would not appear in the equation.

Ok, negative exports avoids double counting. But that just highlights the meaningless equation of demand and supply, investment and savings, liquidity demand and “real” money etc.

BTW I’ve now got to Chapter 6 of Keynes General Theory and its clear that he has a much more subtle definition of concepts than the mush in macro tutorials etc. I will have to study that carefully.

There are reasonably scientific precise definitions of every relevant modern statistical term provided in the UNSNA.

http://en.wikipedia.org/wiki/United_Nations_System_of_National_Accounts

It would probably be useful to rephrase both Keynes, Marx and others using that modern standard terminology (with any necessary supplements).

It would

arthur:

Not only does Hyman Minsky in John Maynard Keynes (available on the kindle) make precisely the same point but he takes it a few steps further by:

a) explaining why and how the GT is a “very clumsy statement” (p. 12)

b) developing an alternative interpretation of Keynes, “one that builds upon those aspects of the GT that emphasize investment in a world where business cycles exist and engender uncertainty” (p. 17)

Tnx, found Minsky on JM Keynes here:

http://s64.filesonic.com/download/50670941/4e7703a8/3052d5d/0/1/3aafd1d7/0/e64f71335d5be05c80f153f78cdfc05f9bc49740

Or after delay here:

http://www.filesonic.com/file/50670941/0

Ok I’ve finished Book II of Keynes GT and chapter 2 of Minsky on Keynes. Chapter 1 of Minsky includes a rapid summary of the “neoclassical synthesis” (including “bastard Keynesianism”) and Book II of GT includes essential detailed definitions.

Unfortunately both are written with an assumption of familiarity with mainstream (neoclassical) macroeconomics. Eg Keynes warns at the start that GT is addressed to economists rather than the public and Minsky just casually introduces the Samuelson multiplier-accelerator second degree difference equation without attempting to explain it. So I will either have to read them again very carefully or first catch up through more introductory texts.

I think I will plough on through Minsky before returning to GT as I do feel I am picking up some sort of “gist”. But I may switch to Simon Clarke on Keynes and on Marginalism first, or mainstream texts like Mankiw (easily available online).

Main problem is that I can’t suspend disbelief when told that Inventory = Savings etc so I lose motivation.

My eyes kept glazing over at the subsequent fairly elementary maths in a way that they don’t when reading more difficult maths in microeconomics texts or more theoretical capital dynamics like Bliss or Burmeister. Its sort of like trying to follow the detailed arithmetical calculations in a treatise about the numbers of angels that can dance at the end of a needle.

Bill, only just noticed your:

http://strangetimes.lastsuperpower.net/?p=1862#comment-10846

You are confusing constant capital (intermediate and auxiliary goods and services plus depreciation on fixed capital) with fixed capital.

Aggregate Demand should be total of all purchases, including raw materials and semi-finished goods that are consumed as current inputs. Not “value added” or factor incomes as used in the macro tutorial.

Keynes does discuss his reasons for netting that out with the idiosyncratic terminology “user cost”. (Seems to me to slide over essential issues of disequilibrium that are clarified by Maksakovsky).

The whole concept of “GDP” avoids the issue and doesn’t even attempt to separate new investment from replacement of depreciation (partly because it is extremely difficult to do). See vol 2 of capital.

Whoops, I was referring to the September 19, 12:13 comment:

http://strangetimes.lastsuperpower.net/?p=1862#comment-10844

Also, Minsky’s rapid summary of neoclassical synthesis is chapter 2, not chapter 1.

Just finished chapter 3 of Minsky which is much easier going. What I like is its agreement with Marx on disequilibrium and cycle, which unlike neoclassicals etc enables a sound basis for considering financial issues.

But it suggests that mood swings drive investment fluctuations rather than “real” disproportions driving mood swings.

mentioned by arthur above:

https://files.warwick.ac.uk/simonclarke/files/pubs/mmm2.pdf

Marx, Marginalism and Modern Sociology, Macmillan, London. Revised and Expanded Edition, 339pp., 1991. by Simon Clarke

Ch 6 Marginalist revolution

Ch 7 Irrationality of marginalism

contain a very useful description and rebuttal of marginalist theories.

I’m sorry I haven’t had time to respond to the recent posts, and don’t have time yet to do so in any detail now. But there are a few high-level points I’d like to raise.

1. On empiricism: Bill agreed with my earlier comments about models, but disagreed on the relevance of empirical data. The basis for the disagreement stems from what Bill describes as the empirical evidence that “socialism has failed.” Naturally, if that were the case, a rational individual must abandon the ideological structures which supported the failure. Not to do so is a symptom of magical thinking, and to force competing ideologies into caricature necessitated by one’s own ideological structures, failed or not, is to abdicate reasoned thought and adhere to religious orthodoxy.

Reasoned thought operates on two principles. Thinking must be rationally modeled, and thus internally coherent. Models must be subjected to empirical rigor in order to validate it. It must, given certain inputs, output data which correlates to the material world. If not, it isn’t necessarily wrong, but at the very least, it is useless practically.

2. Model Competition: Much has been made of the superiority of Marx’s model, on the presumption that it’s more comprehensive explanation is superior, and thus more accurate, by definition. Tomb’s quoting Krugman is the most succinct example of the underlying thought which animates this kind of discussion. Arthur, leveling his lance at windmills, goes so far as to try to refute Keynesian models, or at least the Hicksian ISLM curve, by employing contradictions to Keynes he thinks he has found in Marx. But this is a futile attempt; absent empirical data, competing models can only – if they are equally internally coherent – provide over-determination. Even if one were to be invalidated, it wouldn’t validate the other.

The comparison between them is surely a valuable exercise. But the comparison should be rigorous, not the rantings of yet another blogger disproving the “arbitrary dogmas” of the “conventional wisdom” with facile assertions. Karl Popper, in attempting a refutation of the Marxist conception of historicism, spent quite a bit of effort developing historicism into the strongest form he could, to make his refutation of it all the more credible.

3. Testing Maksakovsky: While this thread is supposed to be about understanding Keynesian thinking, the Maksakovsky quote provides a useful counterpoint. Arthur provided M. as a corrective to what he perceives as deficiencies in Keynesian models. I plan to look more closely at this argument when I have more time. But at the risk of setting myself up later, I’ll point out the immediate criticisms of M. that came to mind.

Does M.’s description of a crisis resemble our current crisis? M. described a generalized crisis of over-production, in which the processes of over-accumulation resulted in a falling rate of profit due to the inability to manage prices. But this looks nothing like our current situation, in which the crisis was the immediate result of a financial panic. Marxists will object that the financial panic was itself caused by other factors in the real economy. Agreed. We will perhaps point to the real estate market in the US as an example. Yet the real estate bubble was in large part the result of changes made in the financial sector’s approach to lending, and it was the financial sector which, in collapsing its available credit, threatened to bring down the real economy with it. This is much more in line with Minsky’s thinking than Maksakovsky’s.

What would the results of M.’s advice be? M. advises that financial institutions, including governments, make their funds less available, and charge more for the funds that are available. This, of course, was exactly the response to the Great Depression in the US under Hoover. The result was an existential crisis in American capitalism which, until FDR instituted policies making money and credit more widely available, showed no signs of abating.

There are contemporary stories, too. Take GM, for example. If it had gone out of business, which it would have done without access to credit, in addition to a significant increase of unemployment due to its now out of work employees, its ancillary business partners would have been driven out of business. The parts suppliers, for example, would have been unable to continue profitably. Their collapse would have significantly affected Ford’s business model, weighing on them at precisely the wrong time. A million or more jobs would have been lost, reducing aggregate demand further. Detroit’s car industry would have died – and had it done so, it would never return.

What about the working classes? It used to be that well meaning Marxists could draw confidence from the doomsday scenario recommended by M., because they felt confident that the resulting social pressure would facilitate a socialist revolution. But it didn’t happen, and where revolution did occur, per Bill’s despair at the empirical record, it failed. There is thus now no workable solution to the chaos M. prescribes. It is, obviously, a brutal, maximalist solution. Without a better solution at hand, those of you who abide by it are objectively working against the interests of the working class.

To return for a moment to the problem of the longer term, consider this. If we accept that in the short term Keyensian models are well suited to dealing with our immediate demand crisis, why should this represent a problem for the future of capitalism? Tomb’s point is pertinent: just because we don’t need to fill a flat tire through its hole doesn’t mean we don’t need to fix the hole. Neither does it mean the reflation will cause a blow-out in the next mile or two, or ninety. If the real problem is that homeowners are so far underwater that it is driven down aggregate demand for the entire world, then I suggest that making additional funds for them less available and more expensive is not the solution.

Lupin3

Looking at the current situation and the current data we can see that QE1, QE2, have kept the ship afloat but have not solved the problem. QE3 a much more tentative step in the same direction will not be any more successful. There appears to be no confidence in the move (markets certainly don’t like it)even from the fed who basically give the impression that they have no answer and in light of lack of policy and direction from politicians need to be seen to be doing something but are wary of the consequences.

Maksakovsky was analysing the causes of crisis and in doing so observed the the resultant upswing. He wasn’t giving an answer to the problem as he clearly saw there was no answer other than to get another system. It is Keynes who didn’t know the cause and yet claimed to have the answer and that answer was only a short run fix which one imagines implies a either a finger in the dyke or a prelude to the answer. We know he didn’t find the answer so it is just a finger in the dyke.

Marxists are not responsible for capitalism. The fact that Marxists were aware of the inherent contradictions of capitalism doesn’t make them responsible for them. Trying to deflect the blame to Marxists is a trick capitalists have used to hide their own lack of understanding in your case I’m putting it down to frustration for the minute.

Warning of the crisis was the responsible thing to do. It could never be a Marxist solution as capitalism isn’t Marxist. However it is and will be brutal and that’s not Marxists fault for pointing it out it’s yours for supporting a system that has this outcome. I am not happy to sit here and watch people suffer. If the system doesn’t work (and Marxists aren’t running it)then get rid of it. You seem to be so attached to capitalism you will live with the brutality of it.

You talk about the support for GM Chrysler etc as though the crisis is over they are saved and the policy worked. From where I’m sitting I understand why a survey in the wall street journal yesterday discovered that 85% of Americans surveyed thought that the US economy was worse than 2009 and would be even worse next year. The market expects a double dip and all indications are that they are right.

ttp://link.ft.com/r/R5WAEE/QNLBYF/95H05/TUP37M/DWYD1F/AZ/h?a1=2011&a2=9&a3=22 it over with as quickly as possible. Personally I don’t want the crisis at all and would like to avoid it for all time.

an interesting comment on the feds policy

ttp://link.ft.com/r/R5WAEE/QNLBYF/95H05/TUP37M/DWYD1F/AZ/h?a1=2011&a2=9&a3=22

Sorry Tombs, that’s not quite right. Leaving aside the technical inaccuracies in your reply (Keynes and Maksakovsky), I’ll just point out that you haven’t bothered to respond to my points at all. I didn’t say Marxists were responsible for capitalism. I said that Marxists who prescribe the kind of brutal, maximalist, and failed capitalist policies M. does without providing a workable alternative have abdicated their support of the working class.

That M. is arguing as a capitalist from the point of view of a Marxist is immaterial to the criticism. Or rather, it is material to the practical uselessness (or worse) of the so-called orthodox Marxist view.

Lupin3

Marxists are not prescribing anything for capitalism rather pointing out the inevitable and unavoidable so there’s no prescription. M is merely pointing out that there is no prescription and the consequences of misguided prescriptions.

I agree the alternative is the issue but Keynes is not offering an alternative just a quick (and short) fix. Not having the alternative doesn’t preclude one from pointing out the inevitable and the uselessness of finger in the dyke policies.

Lupin 3,

Actually I said socialism had failed so far according to the empirical evidence. In one sense this is true, in another sense it is false. I won’t go into examples on this thread since others may use it to spam the thread. But, in any case, apologies for the glib shorthand in response to your empiricism argument.

I will attempt at some stage to provide a more comprehensive account of scientific method wrt political economy. I don’t believe empiricism in this is sufficient. Given world history what empirical evidence would satisfy you? Attempts to build socialism starting from economically backward economies in countries such as USSR or China, in a hostile surrounding capitalist environment are bound to provide evidence that can be interpreted in various ways. The early days of capitalism, including some reversals over fairly lengthy historical periods, also provided contradictory evidence, depending on perspectives in those times.

It is clear that Marx was trying to understand capitalism in a fundamental sense, through exploring its inner contradictions, and that Keynes was not doing that. It is also clear that Keynes can never be refuted empirically since it can always be argued that his methods were never tried in the way they should have been tried. By its nature political economy has to be messy and theoretical, a big part of the argument is over method and IMV the mere assertion of empiricism as a lodestone is insufficient. But as I say, a more comprehensive argument is required.

On the contrary, Maksakovsky does make a prescription for the financial sector in Arthur’s quotation above, mitigated though it is with that sector’s inseparability from industry. He does so because his repudiation of what amounts to Keyensian policy requires it. He repudiates Keynesianism because his understanding of Marx requires it. In my view, it seems quite possible that this necessity for repudiation is founded on Marx’s irrational view of money.

The rest of your comment only suggests you haven’t actually read the post you’re criticizing.

On the contrary “somewhat ameliorate the catastrophic reversal”… is not a prescription or solution or prescription for a solution. Somewhat ameleriote is just that and I would suggest again an observation of what might be the best way to approach the inevitable crisis as opposed to avoiding it

1. Tangentially on empirical models. In a future society social control over the economy would go together with an ability to predict it. Anyone able to predict economic fluctuations under capitalism would at the same time eliminate those fluctuations through arbitrage.

2. The Hicksian stuff (and a fair bit of Keynes) is notoriously refuted by the empirical results of earlier stagflation and the current inability to prevent a slide into recession. Eg there is a massive monetary expansion and zero interest rates but investment does not respond. Unambiguously the theory is wrong.

3. There are significant differences between the description Maksakovsky gave (of cycles before the Great Depression) and the post-WW2 experience. What is striking are the similarities. Although financial panics did sometimes occur without a “real” crisis it is not seriously disputed that the recent GFC is closely tied to an underlying “real” crisis as were the nineteenth and early twentieth century crises.

4. A characteristic feature of both previous cycles and the present one is that overproduction and overaccumulation induced by high prices is amplified by the over-extension of credit which postpones the inevitable crash of prices. Describing that credit expansion in relation to housing as “policy” changes nothing. Without it the construction industry would have run out of steam a decade earlier (and a lot more Americans would be unhoused). Likewise for Detroit, there is massive overcapacity in the auto-industry world wide and bailouts merely postpone the consequences of that.

5. I find Minsky’s description of the financial side quite compatible with Marx and Maksakovsky. The fact that prosperity induces fragility is a nice dialectical flourish, but it only amplifies rather than creates the underlying cycle.

6.

That is a complete misunderstanding of Maksakovsky. His point was that the only way to reduce the magnitude of a crisis is to bring it on earlier. Tightening credit and raising interest rates would end the boom earlier and result in a smaller crash. There was no suggestion that doing so AFTER the crash would help end the depression.

7. Also I pointed out that central banks had in fact been committed to a partial implementation of that policy (the other side of Keynesianism) in their periodic credit restrictions to prevent “overheating” which did seem to have prevented booms from getting out of control throughout the post-WW2 period but without actually putting an end to the continuing buildup of disproportions by bringing on the crisis.

8.

That is neither the problem nor its solution. If workers can’t afford to buy the homes they build lending them the money merely turns that problem into a financial crisis. It didn’t solve anything.

The solution is to expropriate the wealth owned by a tiny minority. If you want to borrow it from them you have to pay interest so they can get richer. The only other option is to actually take it off them.

Arthur in point 2 you state that unambiguously the theory is wrong. Aparently 1970’s stagflation disproves Keynes.

As Krugman argues this is just conservative propaganda.

Stagflation of the 1970’s was caused by massive rises in the costs of inputs ie the 2 oil shocks and due to Nixon’s monetary policy that entrenched inflationary expectations.

Don’t take my word read the analysis of the Economist and Republican Ken Rogoff

http://www.economics.harvard.edu/files/faculty/51_Bush_Throws_A_Party.pdf

Oil shocks are an example of the sort of sharp rises in raw material prices that signal the end of a boom. (Similar phenomena now).

Nixon’s monetary policy that “entrenched inflationary expectations” is best expressed by this phrase:

http://en.wikipedia.org/wiki/We_are_all_Keynesians_now

Arthur there were 2 oil shocks during the 1970’s. The second one was in 1979. How can an event in 1979 signal the end of a boom? by then we were years into economic stagflation.

Steve,

For a more comprehensive explanation of the 1970s stagflation, oil shocks and the crisis in Keynesianism see Ch. 11 of Simon Clarke’s Keynesianism, Monetarism and the Crisis of the State. Better than Rogoff.

A major difference between previous cycles and the post-WW2 cycle is the protracted absence of a clear cut ending of the boom, crisis and beginning of a depression. (It only becomes obviously “cyclic” AFTER that, until then illusions about capitalism having become cycle free continue). I don’t have a clear picture of the new situation, but I believe that the stagflation in the 1970s was a “signal” of the end of the boom, which however only introduced a long period of successful postponement of crisis and depression (eg through continued credit expansion), the results of which may now be coming home to roost.

As I said back then:

I certainly didn’t expect it to last 3 decades, but unlike others I did expect it to end up the way it now seems to be.

We now seem to be in phase where a number of governments are facing bankruptcy. That might be further postponed by devaluation of currency (“quantiative easing”) but that doesn’t lead to restored prosperity.

Forgot to include the link for above quote:

http://www.lastsuperpower.net/docs/unemploy-rev7

I just read that whole section 5 again. Despite the inadequacies explicitly admitted at the start and end, I think it has held up rather well and recommend reading it again to others for the purpose of this discussion.

Arthur you state that the oil shocks are typical of the run up in resource prices that signal the end of a boom. I guess that you are having some sort of joke because the oil shocks of the 70’s look nothing like the run up in resource prices that we are currently experiencing. Ok I get the joke you talk nonsense and we all laugh.

arthur referenced Anitra Nelson on “Marx’s Concept of Money” above. There is a critical review of this by Phillip Anthony O’Hara: Money and Credit in Marx’s Political Economy and Contemporary Capitalism

http://www.hetsa.org.au/pdf/32-RA-2.pdf

Just to be clear oil prices went down all through the long boom which ended with the stock market crash of Jan 1973. The first oil shock came in October 1973 and was an embargo on sales rather than as an expression of market forces. Still if you want to believe something else theres no law against that.

http://www.wtrg.com/oil_graphs/oilprice1947.gif

Steve, http://www.wtrg.com/oil_graphs/oilprice1947.gif is a broken link.

It works fine for me

Lupin3,

You said these things earlier in the “marx and the domains of ignorance” thread:

August 5:

August 13:

So there is a pull towards factor here (Keynesianism can apparently solve eco crises) and a push away factor (Marx may be wrong about money). It is also apparent that you are doing or intend to do some serious study of economic history. I agree it’s important to do that study of economic history. But my study of economic history so far arrives at different but not final conclusions.

* That the apparent success of Keynesianism following WW2 can really be put down to a boom that was likely to happen anyway following the conditions that arose at the end of that war. “Keynesian policies played little active role in promoting the

boom”, pp. 280-81, See Simon Clarke, Chapter 10 Post-War Reconstruction and the Keynesian Welfare State (kmcs)

* That Marx had a superior (although incomplete) understanding of how to investigate the economy in general and money in particular than Keynes, Mill, Say and Ricardo. See From Political Economy to Economics by Milonakis and Fine

We read different versions of the same world history and reach opposite conclusions. I offer no conclusive evidence here that I am right and you are wrong. I’m just trying to refocus the discussion on the real differences as stated by you so far.

Steve perhaps you are a subscriber (or at any rate have acquired a cookie that enables access)? Your link redirects to:

http://www.wtrg.com/nohotlinking.jpe

Well try

http://www.wtrg.com/prices.htm

thats the whole article that I took the chart from

If that doesn’t work the stuff comes from WTRG Economics Oil Price History and Analysis

The graph clearly shows spikes at the end of the 1970s and recent boom periods.

Here’s a graph showing similar spikes for a general commodities index.

http://www.hks.harvard.edu/fs/jfrankel/CommodityParices1960-2011.jpg

I take it you aren’t disputing that Nixon’s monetary policy was Keynesian.

Arthur you stated that “Oil shocks are an example of the sort of sharp rises in raw material prices that signal the end of a boom. (similar phenomenon now)”

Raw materials have been on a sharp rise over the past 6 years.

During the long boom oil prices declined.

Oil shock one came 9 months after the stock market crash (The crash was the signal that the boom had ended) and was due to a political shock rather than an economic one. Oil shock two happened years after the recession of the 1970’s had started.

How can you say that the oil shocks signal the end of the boom when shock number two occurred six years after the boom ended.

Answer this and Ill answer your Nixon question.

I don’t have a good answer. My picture is that UNLIKE previous cycles there was a post-war boom that ended at the end of the 1970s, not followed by a crisis, depression and recovery, but many decades later resulting in the crisis we seem to be headed for now.

I don’t have a good handle on the very long period of “teetering” in between but I agree with those who see present problems as going back to the 1970s rather than as a separate cycle following a recovery from the 1970s. (More obviously current events are a continuation of the 2007-2008 GFC which, despite numerous claims was not followed by a recovery, since it was not followed by a crisis and depression).

The 1970s oil shock was clearly much greater than for other commodities because of specific factors unique to oil (delayed formation of the oil cartel). Its unique height would account for the subsequent greater decline. Nevertheless the overall pattern of two separate spikes is common to both oil and other commodities and typical of what happens at the end of a boom.

What is NOT typical is the absence of a crisis and depression between the two “ends of booms”. My suggestion is that could be put down to the “success” of Keynesian credit expansion in artificially prolonging the boom, but in a way that intensifies the eventual crisis.

That phenomena did not exist in cycles prior to the Great Depression. Though it is worth mentioning that “stable” prices in the 1920s should have been falling as they were in the nineteenth century. This misunderstood “stability” and “prosperity” of the “roaring twenties” was in fact an artificially prolonged boom with credit expansion keeping prices from falling instead of actually rising and was followed by an exceptionally heavy crash.

Likewise the long period of post-WW2 steady inflation is clearly the direct result of monetary efforts to prevent what would otherwise be a long term decline of prices.

Incidentally, although that is quite an unsatisfactory conception of a “cycle” it should be noted that it has never been a uniformly “periodic” cycle. It has always been irregular. Each phase creates the conditions and forces that make the next phase the most likely outcome, but without a rigid timetable and perhaps without ruling out the occasional possibility of reversion to previous phases (“double-dip”).

Thank you for answering the question.

I find that your link to commodity prices is broken.

As to Nixon being a Keynesian or that his monetary policy was Keynsian well I remain sceptical that that is true.

Again I submit the Rogofg article

http://www.economics.harvard.edu/files/faculty/51_Bush_Throws_A_Party.pdf

In this article he states that “In the run up to the 1972 election, he printed money like it was going out of style,….”

I believe as does Rogoff that Nixon expanded the money supply in order to have a boom at re election time regardless of the consequences.

I guess this is Keynsian if we can just find a quote from Keynes where he says that politicians should use economic levers in their election campaigns and bugger the consequences.

Bill, thanks for the link to O’Hara’s review of Nelson on “Marx’s concept of money”. I found it much more interesting than the book so far. I’ve reached pdf p47 (chapter 4) without finding much of interest so the review may save me from continuing. (Though I am inclined to resume later since money is central and understanding the misunderstandings is also necessary).

Review has pointers to other literature on money that looks as though it would be more useful. Will follow up later. If you locate links to them, please post.

On the need for a positive program I would suggest a separate topic on “wealth tax”. Wikipedia has some good starting points which link to useful statistics:

http://en.wikipedia.org/wiki/Wealth_tax

http://en.wikipedia.org/wiki/Wealth_condensation

http://en.wikipedia.org/wiki/Distribution_of_wealth

http://en.wikipedia.org/wiki/Wealth_inequality_in_the_United_States

http://en.wikipedia.org/wiki/Economic_inequality

http://en.wikipedia.org/wiki/Capital_flight

Unlike the usual Keynesian stuff, reformist proposals for wealth taxes have the benefit of actually providing a plausible solution to budgetary crises and sharply raising the property question since revolutionaries can propose steep progression from the insignificant rates currently contemplated to actual expropriation.

Major arguments against are:

1. High cost of administration (but this cost is necessary to facilitate future expropriation by having detailed records of ownership etc).

2. Capital flight, which leads directly to other “antiquated” demands from the Manifesto like confiscation of the property of emigrants and rebels.

I’ll elaborate if a new topic is started.

arthur,

I did come across another interesting money paper but not from O’Hara:

Georg Simmel’s Philosophy of Money, RKP, London, 1978

http://moneyandthebrain.com/ebooks/philosophy_of_money.pdf

“Despite its idealist formulation, remains the most penetrating phenomenological exploration of the social power of money”(comment by Simon Clarke)

There are some interesting Phil O’Hara downloads about money and other topics available here, including

– Money credit and finance National regional and global dimensions

Other interesting material there too but some of it is off topic to this thread. This one could perhaps form the basis on another thread (Cultural Contradictions of Global Capitalism)

Sorry, the link (broken above) to the full listing of Phil O’Hara information and publications is:

http://www.business.curtin.edu.au/index.cfm/business/staff-directory?profile=Phil-O'Hara

Both O’Hara and Simmel look very interesting (though Simmel also looks “heavy”). I have pausing Nelson and Minsky and several philsophical works on Hegel and Aristotle for lighter (and much quicker reading. Just finished Bellamy “Looking backward” and resumed start of William Morris review of it plus alternative “News from Nowhere”. Also started Simon Clarke on Keynes. There seems to be a vast amount to catch u[!

(partly in reply to arthur’s query on another thread, read mmm2 before kmcs or perhaps both together)

Lupin3 on Sep 14:

Keynes said somewhere that capitalism’s problems were akin to a car with alternator problems, that the whole car or engine did not need replacing. Contrary to what you say above Lupin3 I did acknowledge earlier that the specificity of the Keynes fix may have been a strength rather than a weakness of his theories.

I’ve been thinking about this more and I think it’s part of a broader question of how we understand and interpret the history of economic thought going right back to Adam Smith. When you trace it through from Smith to Ricardo to Marx to marginalism to Keynes and later to monetarism temporarily replaces a bastard Keynesian approach then that overview is not a pretty sight at all. This is why I recommend Simon Clarke’s Marx, Marginalism and Modern Socioloogy because he seems to have the knowledge and ability to thread the needle through this murky and misinterpreted history. So, even if Keynes or Minsky / Keen type post Keynes could stabilise the unstable system of capitalism then as thinking humans we still have to consider the fundamentals that the system, the whole edifice has been built on alienated labour and the outstanding analysis of what followed from that provided by Marx and interpreted clearly, as far as I can see, by Clarke. That is not an acceptable way to build a social system from my perspective. So, Keynes was a very intelligent liberal who (a) looked down on the working class, (b) looked at Stalin and didn’t like what he saw and so (c) developed a macro to complement a dysfunctional marginal micro which (d) had replaced a far better analysis developed by Marx. Is this really the way in which intelligent people in 2011 ought to plan for the future of the human race? It just seems like a crock of shit built on top of another crock of shit which turtles all the way down. Moreover the historical evidence, empirical evidence if you will, does suggest strongly that the fundamental propositions of Marx are correct:

– capitalism is dynamic to start with but the internal problems undermine its dynamism progressively

– gap b/w rich and poor increase under capitalism

– overaccumulation generates crises periodically come what may

etc.

This is just a crude thumbnail. I do recommend Clarke who does flesh out these perspectives in a much more erudite manner.

Keynesianism Monetarism and the Crisis of the State as well as being free from Simon Clarke’s archive is also available for 99 cents on the kindle, here (which is the cheapest one can do) if you prefer reading it that way

A useful reminder about the Grundrisse discussion of production/consumption and distribution/exchange:

http://nome.unak.is/nm/5-1/12-reflection-on-the-economic-crisis-/219-the-transcendental-character-of-money-an-exposition-of-marxs-argument-in-the-grundrisse

The introduction is irritating but it gets started at “The Method of Political Economy”[18]

This slogan:

http://en.wikipedia.org/wiki/We_are_the_99%25

prominent in:

http://en.wikipedia.org/wiki/Occupy_Wall_Street

Although still inchoate suggests potential for class based politics.

I like the idea of a wealth tax and exploring it. However I think the demands from such as occupyLA and occupy Wall St are more in line with transperancy. People want a say and this must signal the end of the 2 party system even though the unions and democrats are trying to take over the movement. Won’t go on as realise this is not the thread for it.

tomb, do start a new thread.

just some papers might be of interest from keynesians trying to make some sense 0f it all

http://www.frbsf.org/publications/economics/papers/2009/wp09-05bk.pdf

http://www.frbsf.org/publications/economics/papers

/2009/wp09-17bk.pdf

think in this case they may have given up or are working out of the Vatican

http://www.frbsf.org/publications/economics/papers/2011/wp11-05bk.pdf

one thing I wasn’t aware of, but probably makes sense, will need to look further (couldn’t copy image not sure why)

http://www.bea.gov/newsreleases/international/intinv/iip_glance.htm

net international investment position for the US is now in excess of negative 2 trillion dollars

I haven’t looked at the papers yet. There are an awful lot of such papers. Any particular reason for each being of interest?

Making sense of the graph is very important. It clearly shows a trend growing from the end of the 1980s that is directly opposite to my understanding that developed imperialist counrties with higher organic composition of capital become net exporters of capital to the rest of the world because their rate of profit is lower.

Presumably extending the graph earlier would show reversal of direction starting with the mid-1970s.

At the moment we are seeing a lot of cash flowing to US for safety (presumably a lot of it is repatriation of US profits and perhaps disinvestments previously exported from US and reinvested locally outside US).

Does this apply to whole period since the reversal began?

I don’t feel we can have a good grip without a satisfactory account of this phenomenon. Any pointers?

Will try to find earlier figures but yes my reading was exactly the opposite of what is happening this may be the flight to safety but the graph seems to to be steady and the flight of capital doesn’t seem to fully explain it to me but perhaps a steady increase over a long period of time

The other links were probably just frustration trying to find something with current empirical data that makes sense and no success.

seems that graph is the beginning of the decline. from ’82 to ’89 was positive so perhaps it is the flight to safety and repatriation after all. Will try to fine further detail to establish when the trend started to reverse

http://www.ny.frb.org/research/current_issues/ci9-1.pdf

this paper also refers to the rising dollar as an impact on value of overseas assets but of course that would have the opposite effect for countries such as china post 2008

The related information ==> related links from tomb’s graph has a full release about the graph with tables:

http://www.bea.gov/newsreleases/international/intinv/2011/pdf/intinv10.pdf

Data is provided on the movement of each separate component. I haven’t analysed it. Presumably there are research papers by people who have.

seems that a large percentage of the inflows are bonds but still stocks and other assets are negative also. This may of course be because bonds may not be the only safe haven but other dollar investments , gold companies property etc might attract capital but still strikes me as more significant than safe haven.

not sure why whale rubbish is on this site

U.S. Cross-Border Derivatives Data:

A User’s Guide

“However,to date, no corresponding entry in the financial

account reflects the change in the quantity of U.S.

derivatives claims on, or liabilities to, foreigners.

Thus, the international transactions accounts shown

in the BOP capture only one side of most derivatives

transactions.”

I see they now do account for this in BOP but not very well. Not sure how much this impacts on foreign holdings not sure what other anomalies exist either

I think if you tell people to press the back button when captcha fails then you should tell them they will lose whatever they wrote.

http://www.bea.gov/iTable/iTable.cfm?reqid=9&step=1&isuri=1

table 4.1 gives a better indication perhaps of the flows of international investment for US and looks like a more typical result

Of historical interest (only) Socialism and Marginalism.zip (38MB) includes:

1. “Socialism and Marginalism in Economics 1879-1930” edited by Ian Steedman (.mobi ebook)

2. “The Determination of the Rational Wage Rate” by Frederik Bing and Julius Petersen (1873) translated from Danish by T. L. Johnston, International Economic Papers No 11, 1962, pp60-74 (8 individual double-page bitmap .pdf files).

3. “A Neglected Classic in the Theory of Distribution” by John K Whitaker, Journal of Political Economy, v90, n2, pp333-355 (bitmap .pdf)

http://depositfiles.com/files/rrrg2tj30

Item 1 is a rather academic account of the history, which mentions 2 and 3 in the chapter on Denmark, claiming Bing and Petersen as precursors of marginalist neoclassical theory of wages.

Item 3 is an exposition of item 2 supporting that claim by simply inventing a “demand side” theory added to an easier to follow notation for the non-marginalist “activity analysis” mathematical model developed by Bing and Petersen in 1873 and ignoring their very clear explanation that they were writing in refutation of the classical anti-socialist “iron laws of wages”.

It seems clear from the account in 1 that despite being Social Liberals and making no reference to Marx their theory (now embraced as “neoclassical”) was regarded as dangerously communistic and ignored by the economics profession.

From my quick look I would say it is a reasonable attempt to dress up a semi-Marxist explanation of the complex laws relating wages and accumulation in language that could have been acceptable to mathematically literate bourgeois economists (but wasn’t if there were any). Taking into account that only volume I of Capital had been published and Marx’s Critique of the Gotha Program was still suppressed I think their view is much closer to Marxism than most alleged Marxists.

More modern accounts in this direction (with a much less socialist and much more apologetic tendency) can be found in two books:

4. “Capital Theory and the Distribution of Income” by C. J. Bliss and

5. “Capital theory and dynamics” by Edwin Burmeister.

As indicated in “Unemployment and Revolution” I believe the relation between wages, average rate of profit and choice of techiques with capital accumulation is central to understanding the regulation of wages by formation and absorption of a pool of unemployed. Although the comparative statics used by Bing Petersen and “fake dynamics” in modern versions is not Marxist, at least it recognizes the centrality of accumulation with choices between labour intensive and capital intensive techniques in stark contrast to most of the pseudo-Marxist stuff.

found another interesting reference on money:

http://www.mtholyoke.edu/courses/fmoseley/conference/

Follow link to Papers which include an update by Suzanne de Brunhoff on her interpretation of Marx on money. Other significant authors are there too

Thanks! I’ve downloaded the whole collection on money (except abstracts) as it looks important.

Now finished Bettelheim on Economic Calculation and Forms of Property but still stuck at occupation and currently have no kindle so re-reading Maksakovsky which includes a chapter on the (subordinate) role of credit in capitalist cycle. (BTW I think Maksakovsky should be added to the reddit socialism reading list mentioned elsewhere. Also Engels “Socialism: Utopian and Scientific”).

The importance of a clear account of money is highlighted by the popularity of monetary conspiracy theories among occupiers.

Its necessary to grasp the Contribution and first 3 chapters of volume I as a starting point on money. But its also necessary to continue to credit, banking etc in volume III, which depends on circulation and turnover in volume II. Then there’s important stuff (referenced by Simon Clarke on Marxist Theory of Crisis) in Volume IV (“Theories of Surplus Value”) especially critique of Ricardo on Accumulation and Crisis – and more in Grundrisse.

I had the impression some of the authors at that money conference only covered chapters 1-3 of volume I (which most “Marxists” never try to understand at all) but don’t actually get onto credit and banking etc. Do any of the papers get beyond that?

I think Suzanne De Brunhoff’s 1973 book, Marx on Money (frustrating that cheap commercial copies are no longer available), provides enlightenment about the structure of Marx’s argument about money, that he first developed a general theory of money for all commodity producing societies before going into the analysis of credit under developed capitalism. This explanation of the structure of Marx’s work is reinforced by the second section of Rosdolsky who argues that volume 1 and 2 are a study of “capital in general” with the complications of competition and credit removed.

Hence, money would be required in socialism and the Occupiers who argue that money is the root of all evil are barking at surface phenomena due to their lack of analysis of the nature of production, circulation, the commodity etc.

With De Brunhoff in mind and reading the 2003 conference abstracts I’d be inclined to read these first:

– de Brunhoff because she summarises and updates her argument

– Foley because he asks:

– Germer because he asserts that “several other characteristics suggest that gold still performs fundamental functions of money”

– Bellofiore because he discusses the “nature of banks”

– Smith because he discusses world money

But I haven’t read those papers yet so can’t say whether the promises of the abstracts will be delivered.

Ok I’ve just finished those 5 papers.

Not much light. Though s6 of Foley (p11) at least points out what needs to be done (elaboration and transcending of Marx’s theory of money). s5 also relevant but I didn’t fully understand it.

Of the others only Smith seemed to be of any interest.

Will need to study the serious mainstream literature on how money currently works. Not much sign that they have done so in great depth – unlike Marx.

the patrick murray article is good for value theory, what is money?, hegel, distinction b/w value and price, marx and ricardo etc.

found some more money links, will start a money thread to avoid further pollution of this keynes thread

If the Keynes discussion starts up again then FN31 to Martha Campbell’s Money in the Circulation of Capital looks important: